It is undisputed that bank customers are no longer satisfied with financial service providers, as shown by the 12th World Retail Banking Report 2015 by Capgemini and Efma. The loyalty of customers to their banks is suffering, accompanied by an increased willingness to change banks. 45% of German bank clients have already changed their bank (source: statista). The wishes and needs of customers have been relegated too far into the background.

More customer-centricity is a must

To be able to focus on customers, it is important for banks to know their customers personally and be aware of their motivations. Personal conversations, surveys and internal sources of information, such as transaction histories, can be instrumentalised here. As the handling of customer relationship management online continues to grow, a seamless and real-time flow of information between the online and offline channels of banks is a must. It is important that banks understand how to maintain personal relationships with customers in the virtual realm, because this area is becoming the most important point of contact between customers and banks. Interactions with customers help to close information gaps and strengthen customer loyalty. Today’s pre-informed bank customers want assistance so they can help themselves, and they want banks to stop thinking in terms of products and sales.

Customers complain about long waiting times in customer service areas. A “concierge service” could be a way to counteract this. Deutsche Lufthansa AG with its Miles & More credit card programme or the American hotel chain The Ritz Carlton (source: forbes) provide inspiring examples.

Using appropriate services, banks can respond more quickly to their customers’ pressing requests and needs and deliver an excellent customer experience.

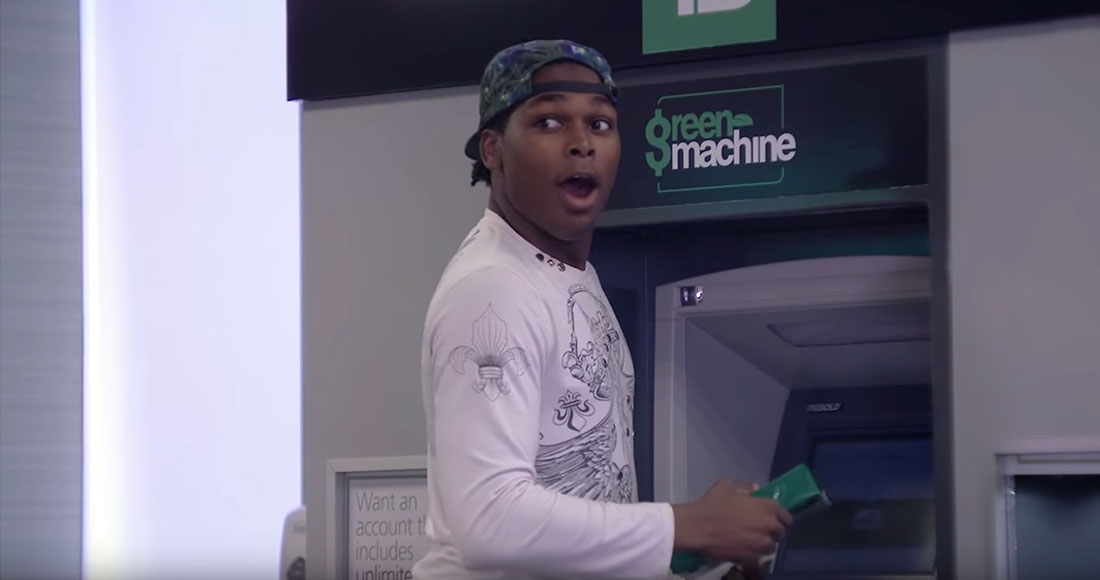

A successful customer experience also means impressing the customer at unexpected times. Instead of sending out advertising letters with discount coupons, in the summer of 2014 the Canadian TD Bank placed “live” ATMs in its branches, who presented personalised gifts to select customers as an expression of gratitude (YouTube video).

Happy Customer of the Canadian TD Bank

Happy Customer of the Canadian TD Bank

New incentive systems for advising customers

The service of advising customers must regain its past importance. It must be worthwhile for a financial advisor to create added value for customers through his or her advice - the brokerage of products should not be the focus of interactions with customers. To do so, it is necessary to adjust the sales monitoring and rewards model. The future core value for the evaluation of an advisor could be customer satisfaction - not the numbers and amounts of product deals. This requires a change in the career model from customer advisor to relationship manager, who supports the client over a long period, regardless of his or her own personal career. Because long-term positive experiences strengthen customer loyalty and lead to a better and trusting relationship.

Advising customers should be flexible. For the financial advisor, this means being available both in the branch office and via video conferencing and chat. The processing of uncomplicated banking transactions, from information to the conclusion of a sale, should be possible via any desired access channel, even online. Technological and legal hurdles have prevented this so far. However, with the introduction of the web-based authentication procedure by BaFin in 2014, a major step has been taken to enable the customer to be authenticated and identified via video conferencing (source: Finanz-Depot).

Building more empathy with data

Despite their gigantic data budgets, banks have little individual knowledge of their customers, rendering them unable to approach said customers in a targeted manner. There is no doubt that they have the necessary tools: Customers entrust such a high amount of personal information to almost no one else as they do to their own bank. However, only socio-demographic data are collected. There is no systematic collection of data on human behaviour, preferences and habits. There needs to be a paradigm shift among banks, which have to put themselves in the position of individual customers, rather than broadly segmenting their customer groups and aligning their services accordingly.

Changing from omni-channel to opti-channel

In the digital age, customers want to do most of their day-to-day banking online. Accordingly, the desire for a smooth integration of online and offline channels is extremely high.

For complex and complicated issues and products, customers want competent support in the form of a personal discussion with their advisor (source: Bain & Company Study - What bank customers really want). Instead of supporting each other, direct sales from branches and online channels are currently competing with one another. To support the customer experience, banks must also succeed in connecting all of the channels with each other to ensure interaction with the customer both online and offline. Information must be equally accessible across all channels and almost every business activity should, as far as feasible, be executed independently of the channel.

Bank customers want more flexibility while being advised. They are already used to using services 24 hours a day, seven days a week from other industries. Here the use of video chats, news services and other alternatives would be conceivable - New Zealand's ASB Bank offers a virtual branch on Facebook, for example. A corresponding social media strategy is indispensable when implementing an omni-channel offering. Social media such as Facebook, Twitter and the like are among the most frequented distribution channels today. Using these instruments also offers a multitude of possibilities to interact with the customer. With regard to digital transformation, the close inter-linking of all channels into an omni-channel structure is unavoidable. In the next step, financial service providers will focus on an opti-channel structure in future: Based on customer behaviour and preferences, the bank automatically suggests the most suitable channel for its customers to use the requested service. However, a flawlessly implemented omni-channel structure is essential here.

In view of the shrinking network of branches, some banks have developed alternative branch concepts. The increasing importance and use of mobile devices raises the question of whether a sales strategy similar to Apple’s sales model in Germany could also be considered for financial service providers: Apple only has 14 flagship stores in highly frequented locations in Germany. In keeping with Commerzbank’s concept in Berlin and Stuttgart, flagship branches would be opened in major cities, supported by numerous alternative branch concepts. However, the most important component is the smooth transfer between the online world and the branches, without media discontinuity, meaning a very closely interlinked omni-channel structure.

Using PFM 2.0 to create the best customer experience

An additional approach to promoting an excellent customer experience and meeting the individual needs of every individual bank customer is the “Personal Finance Management 2.0” platform, which is explained in detail in our white paper (German Language). Here the bank is moving away from being a provider of financial products and becoming a platform provider. The customer and above all the achievement of his or her individual financial goals are at the heart of it. The products selected for this purpose are of secondary importance. The platform is based on a strong relationship of trust between the bank and the customer. In order to achieve their individual financial goals, customers must disclose their individual and personal information to the bank. This process is simplified by the introduction of trust levels, which then define the individual functional scope of the platform. Read more about PFM 2.0 in our white paper (German Language).

Banks have a large number of levers at their disposal to adapt their business model to the new challenges of the financial market. Failure to keep up with ever-progressing digitalisation leads to an accumulation of necessary investments. In addition to these, however, a rethinking on the part of bank decision-makers is the first step necessary to initiate change in financial institutions. Digital transformation is not a question of technology, it is a question of attitude - the attitude towards the needs of customers.

If you are interested or have any questions, please do not hesitate to contact us: call +49 (0)611 . 238 50 10 or by eMail to kontakt(at)diefirma.de.

More information: